On January 17, the Congressional Budget Office (CBO) released its latest Budget and Economic Outlook and Update. It attracted little attention in a media environment flooded with stories about then-incoming President Trump, but it should have been one of the big stories of the year. The CBO takes stock of the incoming administration’s fiscal inheritance, and it is a grim one.

“[T]the federal budget deficit in fiscal year 2025 is $1.9 trillion,” the CBO notes, or “6.2 percent of gross domestic product (GDP).” This comes after a deficit of 6.6 percent of GDP for 2024 and is a staggering number for an economy which is, we are told, booming.

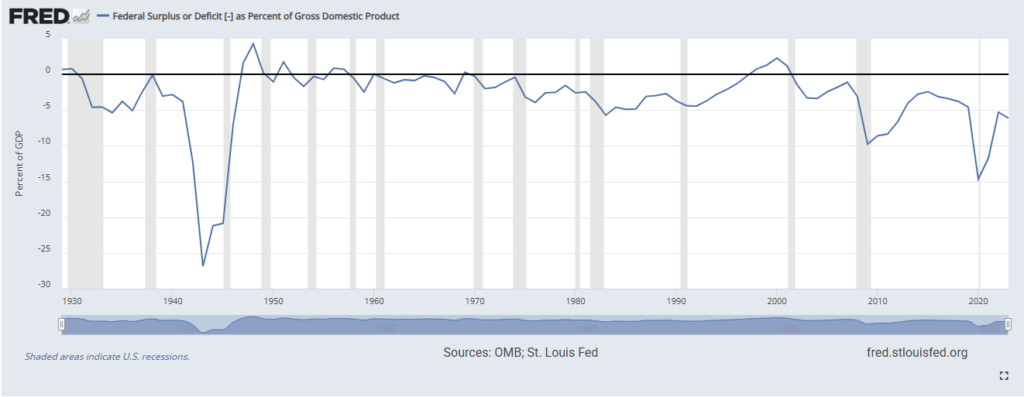

If we go back to World War Two, the only years when the Federal budget deficit has been higher as a share of GDP are the recession and slow recovery years 2009-2012 and the pandemic years of 2020 and 2021. What is worse is that, despite all the “Building Back Better” of the last few years, the Federal budget deficit has actually risen from 5.3 percent of GDP in 2022. Perhaps this vast infusion of borrowed money is why the economy is supposedly “booming.” If so, this sugar rush is not sustainable.

Looking ahead, the numbers do not improve. The deficit is forecast to hit 6.1 percent of GDP in 2035.

The result of these large, persistent, and growing deficits is a large and rapid increase in Federal government debt. “From 2025 to 2035,” the CBO writes:

…debt swells as increases in mandatory spending and interest costs outpace growth in revenues. Federal debt held by the public rises from 100 percent of GDP this year to 118 percent in 2035, surpassing its previous high of 106 percent of GDP in 1946.

In 2035, in other words, the Federal government debt will be larger relative to national income than it was at the end of the Second World War, when we had just defeated Nazi Germany and Imperial Japan.

The deficit arises from an imbalance between Federal spending and revenues. The CBO forecasts that “Revenues total $5.2 trillion, or 17.1 percent of GDP, in 2025” and reach “18.3 percent in 2035.” If revenues are forecast to climb as a share of GDP, the forecast deficit must arise from an even greater increase in spending. The CBO writes that “Federal outlays in 2025 total $7.0 trillion, or 23.3 percent of GDP…reaching 24.4 percent of GDP in 2035…” These deficits and higher debt are driven, then, not by deficient revenues – indeed, the CBO notes that “Revenues remain below their 50-year average in 2025 but rise above it thereafter” – but by excessive spending: “Measured as a percentage of GDP, federal outlays in CBO’s projections exceed their 50-year average every year from 2025 to 2035.”

“The main reasons for that increase,” the CBO continues, “are growth in spending for Social Security and Medicare and rising net interest costs.” Mandatory spending, of which Social Security, Medicare, and Medicaid account for 79 percent in 2025 rising to 84 percent in 2035, is forecast to rise from 14.0 percent of GDP to 15.1 percent over the same period. And, with rising deficits and debt to finance with Treasury yields at levels not seen in 18 years, the CBO notes that:

Net outlays for interest increase as debt mounts. Interest costs exceed outlays for defense from 2025 to 2035 and exceed outlays for nondefense discretionary programs from 2027 to 2035. From 2027 on, interest costs are greater in relation to GDP than at any point since at least 1940 (the first year for which the Office of Management and Budget reports such data).

And this assumes that the rates on 3-month Treasury bills and 10-year Treasury notes decline from 3.8 percent to 3.1 percent and 4.1 percent to 3.8 percent, respectively, from 2025 to 2030-2035.

As a result of this, discretionary spending — which includes defense spending as well as programs such as transportation, education, housing, and social service programs, as well as science and environmental organizations — falls from 6.1 percent of GDP in 2025 to 5.3 percent in 2035. Defense spending falls from 2.9 percent of GDP to 2.4 percent over the same period.

Those who suggest that the budget can be balanced simply by cutting military spending are living in a fiscal fantasy, especially in a time of rising global tensions.

This is President Trump’s fiscal inheritance. He cannot feel too aggrieved, however. His first administration saw an increase in the Federal budget deficit from 3.1 percent of GDP in 2016 to 4.6 percent in 2019, before COVID-19 hit.

The prospects that the second Trump administration will get Federal spending, deficits, and debt under control look a little brighter. President Trump’s choice for treasury secretary, Scott Bessent, has laid out an economic plan known as “3-3-3,” which involves reducing the federal budget deficit down to 3 percent of GDP, getting real GDP growth up to 3 percent, and producing an additional 3 million barrels of oil a day by 2028. The plan has drawn criticism for, among other things, requiring “enormous cuts to programs such as Medicaid,” but there is no path to Federal government solvency that doesn’t pass through major reforms to mandatory spending programs like Social Security, Medicare, and Medicaid, for which there appear to be next to no appetite anywhere on the political spectrum.

But we cannot place all the blame on the politicians. To some extent, they are simply giving the American voters what they want. During last year’s presidential campaign, the candidates for President and Vice President debated for a combined total of 270 minutes. At no point were they asked a direct question about the Federal government’s deficits and debt and what they would do about them. This ought to be the biggest issue in American politics and hardly anybody cares.

There are those who tell you not to worry. “We owe it to ourselves,” they will say, ignoring that “we” and “ourselves” are different people so all it amounts to is that “we” owe it to the holders of Federal debt. Others will tell you that the Federal government can simply print whatever money it needs to pay its bills. The last few years have demonstrated once again what happens when we do that.

Whether you’re one of those who believes that the United States should police the world or one of those who believes that it must attend to its own problems first, fixing the explosion of Federal government debt has to be a priority. Just as America grew strong because it had a strong economy, it will grow weak if its economy is allowed to grow weak under the growing weight of debt. Not for nothing did Thomas Jefferson urge Americans to “place economy among the first and most important of republican virtues, and [regard] public debt as the greatest of the dangers to be feared.”